【Hong Kong, February 23, 2024】According to the MPF market share report released by GUM today, as of January, the total assets in the MPF market have declined by 1.7% to HK$1.12 trillion. In terms of market share, Manulife remains the leader with a share of 27.9%, while HSBC (17.6%) and Sun Life (10.9%) continue to hold the second and third positions respectively. Manulife’s market share saw a more noticeable change, increasing by 0.18% compared to the previous month, primarily driven by investment returns. On the other hand, Sun Life’s market share decreased by 0.16%.

Fourth-ranked AIA saw a slight increase of 0.01% in market share, reaching 9.0%. The competition for the fifth position is highly intense, with BOC-Prud slightly surpassing BCT Group to secure the fifth spot. [Refer to Table 1 for details]

Table 1:Market Share of Top 10 MPF Providers in 2024

| 2024 Change in Market Shares | |||||

| Market Share Ranking | Provider | Market Share | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 27.9% | 0.01% | 0.17% | 0.18% |

| 2 | HSBC | 17.6% | 0.00% | 0.02% | 0.02% |

| 3 | Sun Life | 10.9% | 0.00% | -0.16% | -0.16% |

| 4 | AIA | 9.0% | -0.01% | 0.02% | 0.01% |

| 5 | BOC-Prud | 7.2% | 0.01% | -0.03% | -0.02% |

| 6 | BCT | 7.2% | -0.01% | -0.05% | -0.06% |

| 7 | Hang Seng | 5.7% | 0.00% | -0.02% | -0.02% |

| 8 | Principal | 5.5% | 0.01% | 0.02% | 0.03% |

| 9 | Fidelity | 4.3% | 0.01% | 0.00% | 0.01% |

| 10 | BEA | 2.6% | 0.00% | 0.02% | 0.02% |

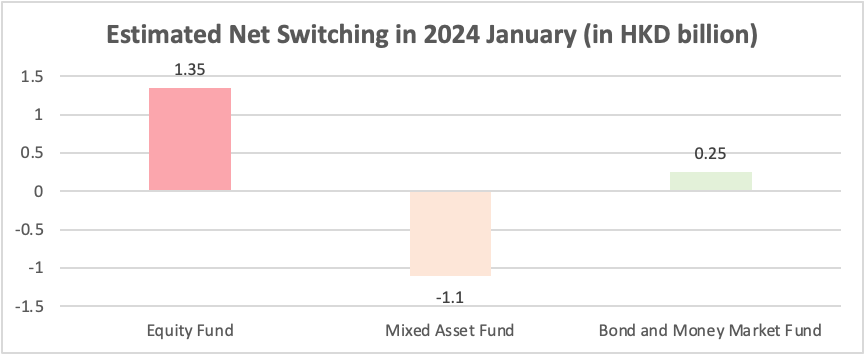

In January 2024, a total of HK$1.35 billion was transferred into “Equity fund”, while HK$1.1 billion and HK$0.25 billion were respectively transferred out from “Mixed asset fund,” and “Fixed income fund”. This could be attributed to the overall strong performance of global stock markets in 2023, which attracted many investors to allocate their funds into equity funds. [Refer to Table 2 for details]

Table 2:Net Fund Switching in Major Asset Categories

In January 2024, the top five fund types with the highest net switching out were “Hong Kong Equity”, “Greater China Equity”, “Mixed Asset (>80% -100% Equity)”, “Mixed Asset (>60% -80% Equity)”, and “Mixed Asset (>40% -60% Equity)”.

On the other hand, the top five asset types with the highest net switching in were “United States Equity”, “DIS Core Accumulation Fund”, “Global Equity”, “Global Bond” and “Japanese Equity “. [Refer to Table 3 and Table 4 for details]

GUM’s Strategy and Investment Analyst, Martin Wan, pointed out, “In 2023, different markets showed divergent performances. The fund switching results in January 2024 indicate that members preferred fund categories with better performance from the previous year, such as “United States Equity” and “DIS Core Accumulation Fund.” However, the US inflation data from last month exceeded market expectations, and the expectation of a rate cut in the first quarter decreased, which could increase the volatility of funds. As the MPF is a long-term retirement investment, MPF members should approach it from a long-term investment perspective and avoid excessively predicting the best market entry timing to chase market fluctuations.“

Table 3: Top Five Fund Asset Types with Net Fund Switching out (in million HKD)

| Rank | Asset Class | January 2024 |

| 1 | Hong Kong Equity | -1,225 |

| 2 | Greater China Equity | -925 |

| 3 | Mixed Asset- (>80-100% Equity) | -855 |

| 4 | Mixed Asset- (>60-80% Equity) | -628 |

| 5 | Mixed Asset- (>40-60% Equity) | -323 |

Table 4: Top Five Fund Asset Types with Net Fund Switching in (in million HKD)

| Rank | Asset Class | January 2024 |

| 1 | United States Equity | 3,140 |

| 2 | DIS Core Accumulation Fund | 807 |

| 3 | Global Equity | 673 |

| 4 | Global Bond | 361 |

| 5 | Japanese Equity | 298 |

- The End -

中文版本:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.