[Hong Kong, November 20, 2024] GUM has released its analysis report on the MPF market for October 2024. As of October 31, the total assets of the MPF market decreased by 2.6% to HKD 1.29 trillion. In terms of market share, Manulife leads with a 27.8% share, followed by HSBC (17.8%) and Sun Life (10.9%), which continue to hold the second and third positions, respectively. Together with AIA (9.1%) and BOC Prudential (7.4%) in fourth and fifth places, the top five providers collectively account for over 72.0% of the MPF market.

From the beginning of 2024 to date, HSBC has seen the most significant increase in market share, rising by 0.21%, primarily driven by investment returns. The largest decline in market share was experienced by Principal, which fell by 0.21%, mainly due to net fund switching out. [See Table 1 for details.]

Table 1: 2024 YTD Market Share of MPF Providers (Top 10)

| 2024 YTD Change in Market Shares | |||||

| Market Share Rank | Provider | Market Shares | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 27.8% | 0.41% | -0.27% | 0.14% |

| 2 | HSBC | 17.8% | -0.02% | 0.23% | 0.21% |

| 3 | Sun Life | 10.9% | 0.07% | -0.18% | -0.11% |

| 4 | AIA | 9.1% | 0.02% | 0.05% | 0.07% |

| 5 | BOC-Prud | 7.4% | 0.06% | 0.08% | 0.14% |

| 6 | BCT | 7.1% | -0.13% | -0.03% | -0.16% |

| 7 | Hang Seng | 5.8% | -0.03% | 0.12% | 0.09% |

| 8 | Principal | 5.2% | -0.23% | 0.02% | -0.21% |

| 9 | Fidelity | 4.3% | -0.05% | 0.03% | -0.02% |

| 10 | BEA | 2.5% | -0.04% | -0.03% | -0.07% |

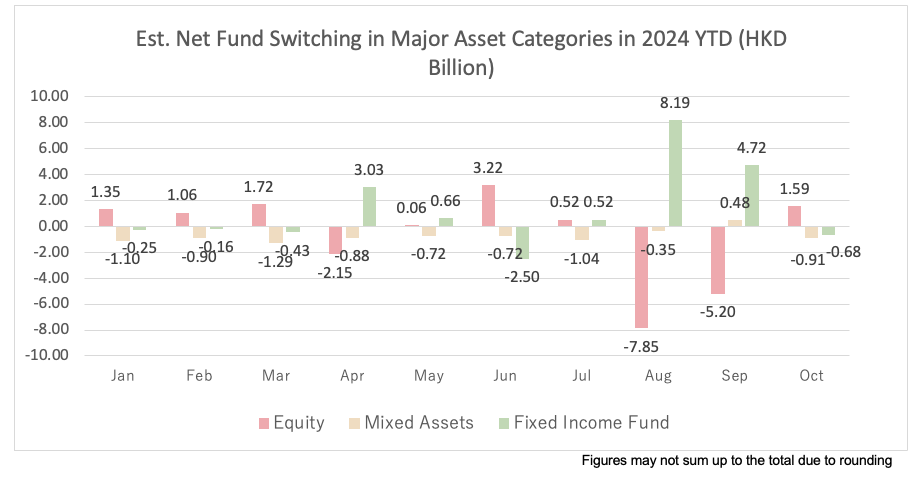

In October, MPF members shifted their asset preferences. As shown in Table 2, net switching out from equity funds decreased from HKD 7.85 billion in August to HKD 5.2 billion in September, reversing to a net switching in of HKD 1.59 billion in October. In contrast, net switching into fixed income funds fell from HKD 8.19 billion in August to HKD 4.72 billion in September, reversing to a net switching out of HKD 0.68 billion in October. In October, rumours circulated that mainland China plans to issue 10 trillion yuan in bonds to stimulate the economy, prompting the market to position itself ahead of the announcement by the National People’s Congress Standing Committee in November. The performance of the U.S. stock and bond markets in October was notably influenced by rising odds for Trump, who advocates for corporate tax cuts and deregulation—policies viewed favourably for corporate operations. However, Trump’s proposals to increase tariffs on imported goods and deport illegal immigrants could lead to short-term labour shortages, raising concerns that these factors might cause inflation to rise in the future, as reflected in the increasing yields on ten-year government bonds. [See Table 2 for details.]

Table 2:Net Fund Switching in Major Asset Categories in 2024 YTD (HKD Billion)

The top five asset classes with the highest net switching out in October were ” Hong Kong Equity (Index Tracking),” “Mixed Asset- (>80-100% Equity),” “Mixed Asset- (>60-80% Equity),” “Conservative Funds,” and “European Equity.” Among these, the equity-heavy “Mixed Asset- (>80-100% Equity)” and ” Mixed Asset- (>60-80% Equity)” have recorded the highest net switching out year-to-date.

On the other hand, the top five asset classes with the highest net switching in in October were “United States Equity,” “Greater China Equity,” ” DIS Core Accumulation Fund,” ” DIS Age 65 Plus Fund,” and “Guaranteed Funds.” The net switching in in October indicate a strong concentration in “United States Equity ” and “Greater China Equity,” with net switching in of approximately HKD 1.86 billion and HKD 1.31 billion, respectively. Notably, this is the first time this year that “Greater China Stock Funds” recorded a net switching in in a single month. In contrast, the net switching in for the third to fifth-ranked funds ranged only from about HKD 0.22 billion to HKD 0.54 billion. [See Table 4 for details.]

GUM’s Strategy and Investment Analyst, Martin Wan, pointed out, “In October, MPF members’ risk aversion gradually diminished, leading to net switching into equity funds again. Besides the popularity of U.S. stock funds, the market generally anticipates new stimulus policies from the central government, prompting members to invest more in Chinese equity funds that are more directly benefited by national policies.

Despite recent political events causing market volatility, members should approach MPF management from a long-term asset allocation perspective rather than frequently trading to capture short-term fluctuations. They should review their investment portfolios periodically based on their risk profiles to ensure suitability.”

Table 3: Top Five Fund Asset Types with Net Fund Switching out in 2024 Oct (in HKD million)

| Rank | Asset Class | 2024 Oct | 2024 YTD |

| 1 | Hong Kong Equity (Index Tracking) | (HK$961) | (HK$6,948) |

| 2 | Mixed Asset- (>80-100% Equity) | (HK$856) | (HK$7,529) |

| 3 | Mixed Asset- (>60-80% Equity) | (HK$687) | (HK$5,695) |

| 4 | Conservative Fund | (HK$635) | HK$6,338 |

| 5 | European Equity | (HK$324) | (HK$1,105) |

Table 4: Top Five Fund Asset Types with Net Fund Switching in 2024 Oct (in HKD million)

| Rank | Asset Class | 2024 Oct | 2024 YTD |

| 1 | United States Equity | HK$1,858 | HK$12,999 |

| 2 | Greater China Equity | HK$1,312 | (HK$4,349) |

| 3 | DIS Core Accumulation Fund | HK$539 | HK$7,158 |

| 4 | DIS Age 65 Plus Fund | HK$339 | HK$3,318 |

| 5 | Guaranteed Fund | HK$219 | HK$1,049 |

- The End -

Chinese Version:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Carmen Tang / Miss Karen Siu

Phone: (852) 9126-9332/ (852) 6011-5603

Email: carmentang@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.