BCT and Invesco Agreement Expected to Impact Provider Rankings

【Hong Kong, November 20, 2023】According to the MPF Market Share Report released by GUM today, the total assets of the MPF market decreased by 2.2% in October, reaching HKD 1.06 trillion. In terms of market share, Manulife continues to take the lead with a share of 27.4%, followed by HSBC (17.7%) and Sun Life (11.1%).

In terms of the YTD changes in market share among the top 10 providers, Manulife experienced the largest increase, with a growth of 0.4%, primarily driven by investment returns (increased by 0.21%). Conversely, Sun Life suffered the largest loss in market share, with a decline of 0.18%, mainly due to the drag of investment returns (with an impact of -0.36%). [Refer to Table 1 for details]

It is worth noting that BCT has reached a long-term agreement with Invesco on the MPF scheme, which came into effect on November 1st. BCT Financial Limited will become the designated scheme sponsor for the Invesco MPF scheme. This will increase BCT’s market share and bring about new changes in the ranking of MPF providers.

Table 1:Market Share of Top 10 MPF Providers YTD

| 2023 YTD Change in Market Shares | |||||

| Market Share Rank | Providers | Market Shares | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 27.4% | 0.19% | 0.21% | 0.40% |

| 2 | HSBC | 17.7% | -0.16% | 0.04% | -0.12% |

| 3 | Sun Life | 11.1% | 0.18% | -0.36% | -0.18% |

| 4 | AIA | 9.0% | -0.03% | 0.17% | 0.14% |

| 5 | BOC-Prud | 7.2% | 0.04% | 0.02% | 0.06% |

| 6 | Hang Seng | 5.8% | -0.02% | -0.04% | -0.06% |

| 7 | BCT | 5.5% | 0.02% | -0.02% | 0.00% |

| 8 | Principal | 5.5% | -0.15% | 0.06% | -0.09% |

| 9 | Fidelity | 4.3% | 0.01% | -0.05% | -0.04% |

| 10 | BEA | 2.6% | -0.03% | 0.02% | -0.01% |

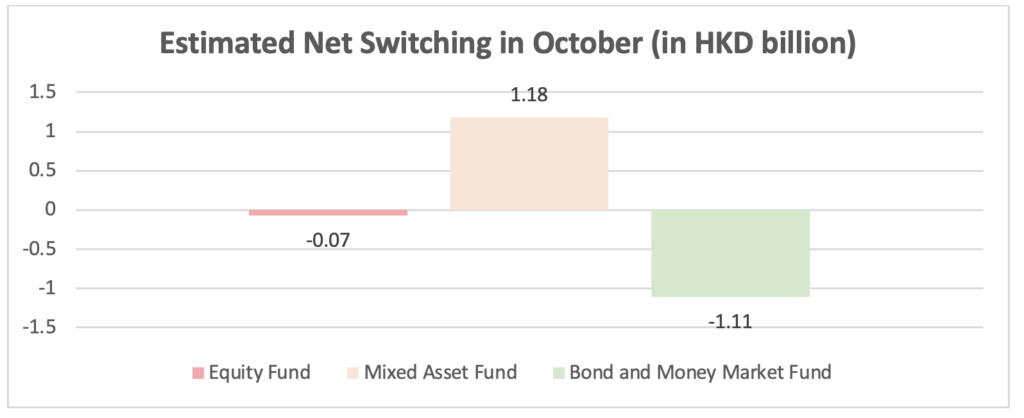

There have been notable asset transfers among MPF members. In October, Bond and Money market funds saw outflows of HKD 1.11 billion, while equity funds had outflows of HKD 70 million. However, mixed-asset funds experienced inflows of HKD 1.18 billion. These changes were primarily influenced by Principal’s termination of three guaranteed funds. If members did not transfer their funds before the end of the month, the related funds would be transferred to the “MPF Conservative Fund” or the “DIS – Age 65 Plus Fund” within the same scheme, explaining the shift in funds. Despite the overall weak global market, the outflow from equity funds was relatively small, indicating some members’ continued optimism about market prospects. [Refer to Table 2 for details]

Table 2:Net Fund Switching in Major Asset Categories in October

Due to the aforementioned reasons, there were relatively significant transfers in the “Guaranteed Fund,” “MPF Conservative Fund,” and “DIS – Age 65 Plus Fund.” In October, the top five funds with net switching out were primarily the “Guaranteed Fund,” ” Mixed Asset- (>80-100% Equity) Fund,” ” Mixed Asset- (>60-80% Equity) Fund,” “Greater China Equity Fund,” and ” Mixed Asset- (>40-60% Equity) Fund”. On the other hand, the top five asset types with the highest switching in included the “MPF Conservative Fund,” “DIS – Age 65 Plus Fund,” “DIS – Core Accumulation Fund,” “US Equity Fund,” and “Global Equity Fund.” [Refer to Table 3 and Table 4 for details]

Table 3: Top Five Fund Asset Types with Net Fund Outflows in September 2023 (in million HKD)

| Rank | Asset Class | Oct 2023 |

| 1 | Guaranteed Fund | -6,850 |

| 2 | Mixed Asset- (>80-100% Equity) Fund | -557 |

| 3 | Mixed Asset- (>60-80% Equity) Fund | -477 |

| 4 | Greater China Equity Fund | -327 |

| 5 | Mixed Asset- (>40-60% Equity) Fund | -218 |

Table 4: Top Five Fund Asset Types with Net Fund Inflows in September 2023 (in million HKD)

| Rank | Asset Class | Oct 2023 |

| 1 | Conservative Fund | 5,665 |

| 2 | DIS – Age 65 Plus Fund | 2,153 |

| 3 | DIS Core Accumulation Fund | 465 |

| 4 | United States Equity Fund | 464 |

| 5 | Global Equity Fund | 153 |

GUM’s Investment and Strategic Consultant, Martin Wan, pointed out, “In October, the termination of individual plan guaranteed funds had an impact on fund switching, resulting in changes in individual asset categories. Despite the overall weakness of global stock markets from September to October, the anticipation of the interest rate cycle reaching its peak and the significant decline in US 10-year bond yields led to a rebound in market risk appetite. This could potentially attract funds to continue flowing into equity funds, particularly US/global funds and DIS.” He reminds MPF members to avoid blindly changing fund portfolios based on short-term market fluctuations and instead determine asset allocation based on risk tolerance and investment objectives.

中文版本:

-The End-

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.