【January 5, 2024】 – GUM has released the 2023 MPF performance result, showing an average annual return of +3.5% and an average earnings of HK$8,171 per person. The Hong Kong and mainland China markets recorded losses of 10-15% in 2023, while the US stock market continued its strong performance with a return of approximately 28%. The active investment types of funds between the two markets differed significantly by 43.4%. GUM advises investors to separate their perception of the overall performance of the MPF from the performance of individual asset classes and actively manage their investments. Employers are also encouraged to provide investment education to employees, enabling them to make appropriate choices based on their risk tolerance.

Regarding the investment outlook for 2024, GUM’s Managing Director, Michael Chan, pointed out “In the United States, inflation is under control, and the economy is expected to have a soft landing. Market expectations suggest that the Federal Reserve may consider an early interest rate cut. In Europe, inflation data aligns with market expectations, and the European economy is expected to gradually recover in 2024. In the short term, high-risk investors may consider allocating some assets to US and European equity funds.”

GUM’s Investment and Strategic Analyst, Martin Wan, further stated, “The United States is entering a rate-cutting cycle in 2024, which bodes well for bond funds. Low-risk investors can continue to prioritize conservative funds as their primary asset allocation. In terms of the Default Investment Strategy in 2023, it is the top-performing mixed-asset fund. The investment was primarily concentrated in the US, Europe, and Japan, with a relative low fund expense ratio (FER) of 0.95%. This makes it an appealing option for medium-risk investors to consider purchasing.”

Monthly performance in December 2023

In December 2023, the “GUM MPF Composite Index” rose by 2.2% to 225.4 points. The “GUM MPF Equity Fund Index” increased by 1.9% to 293.6 points. The “GUM MPF Mixed Asset Fund Index” rose by 3.3% to 230.1 points. The “GUM MPF Fixed Income Fund Index” increased by 3.1% to 125.6 points. In December 2023, the average earnings per member of the MPF were HKD5,211, with an average annual earnings per member of HKD8,171.

Table 1: Overall performance of MPF and average return in December

| Index | Value | 2023 Return(%) | December 2023 Return (%) |

| GUM MPF Composite Index | 225.4 | 3.5% | 2.2% |

| GUMMPF Equity Fund Index | 293.6 | 0.8% | 1.9% |

| GUM MPF Mixed Asset Fund Index | 230.1 | 7.2% | 3.3% |

| GUM MPF Fixed Income Fund Index | 125.6 | 3.1% | 0.9% |

| Average MPF Gain/Loss Per Member Note 1 (HK$) | +8,171 | +5,211 | |

Review and Outlook

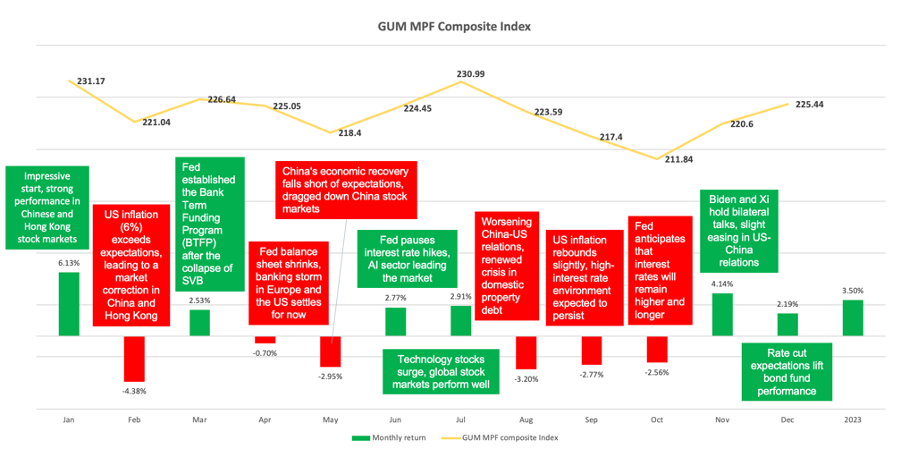

The US stock market has shown strong momentum, particularly in the technology sector. The Nasdaq Composite Index has surged by over 40%, while the S&P 500 Index has also risen by 24%. Meanwhile, better-than-expected inflation data in Europe has driven a 12% increase in the MSCI Europe Index. Japan maintained an ultra-loose monetary policy in 2023, and its stock market performed well with a gain of 28%.

On the contrary, the stock markets in China and Hong Kong have continued their downward trend. Weak economic data in China, despite a rebound in the Hang Seng Index to around 17,000 points by the end of December, resulted in an overall decline of approximately 14% for the year.

Chart 1: Monthly Return Analysis for 2023

Analysis of Equity Fund Performance

China & Hong Kong

In 2023, both the China and Hong Kong stock markets exhibited weak performances. The Hang Seng Index experienced its fourth consecutive year of decline, with a cumulative drop of 13.8% for the whole year. This made the Hong Kong stock market one of the worst-performing among major stock markets. It fell by 2,734 points throughout the year, resulting in a total decline of 11,142 points over the four-year period. Foreign investors remain cautious about the Chinese market. Despite the relatively low valuations in the Chinese and Hong Kong stock markets, they have yet to attract a significant influx of investors.

United States

The US technology stocks have performed exceptionally well, with the Nasdaq Composite Index surging over 42%, far outpacing the 24% rise in the S&P 500 Index. This can be attributed to the strong performance of several technology giants, with Nvidia experiencing a gain of over 200% in 2023. Furthermore, the United States will hold its presidential election in November 2024. Based on historical data, in the past 11 elections, the US stock market has recorded gains in 8 of them. Therefore, there is an optimistic outlook in the market regarding the performance of the US stock market in 2024.

Europe

According to official data from the European Union, the inflation rate in the Eurozone has dropped to its lowest level in nearly two years. The Consumer Price Index (CPI) and the Core Consumer Price Index (Core CPI) have both declined to 2.4% and 3.6% respectively. In the UK, despite a decrease in the inflation rate to 3.9%, the recent monthly economic confidence index reached its lowest level since August, nearing the lows of 2023. An increasing number of investors are starting to bet that the Bank of England will cut interest rates earlier to support the economy.

Asia Pacific

In 2023, the Asian markets performed well. The Indian stock market experienced eight consecutive years of growth, with a market capitalization surpassing $4 trillion, making it the seventh-largest market globally, surpassing Hong Kong. Since the global pandemic, many supply chains have shown a trend towards diversification away from China, presenting opportunities for other Asian countries. In 2024, there will be several key elections in various countries or regions that could have an impact on the Asian markets, including India, Taiwan, and Indonesia, among others. Investors should closely monitor the election outcomes and related policy changes to make informed investment decisions.

Japan

In 2023, global investors flocked to the Japanese stock market, driving the Nikkei Index to its highest level in over 30 years. The index recorded a cumulative gain of approximately 30% for the year. The Japanese stock market benefited from low valuations, accommodative monetary policies, and the economic recovery following the pandemic, attracting the attention of many investors. However, the Bank of Japan has indicated that it is not in a hurry to relax its ultra-loose monetary policy. Wage growth and consumer demand will be crucial factors in determining the exit from ultra-loose policies.

Table 2: Ranking of Equity Fund Performance According To 2023 Returns

| Ranking | Equity Sub-category Fund Index | 2023 Return(%) | December 2023 Return (%) |

| 1 | United States Equity | 27.9% | 4.5% |

| 2 | Japanese Equity | 24.3% | 2.7% |

| 3 | Global Equity | 19.8% | 4.3% |

| 4 | European Equity | 19.7% | 5.1% |

| 5 | Other Equity Fund | 6.7% | 4.1% |

| 6 | Asian Equity | 4.3% | 4.0% |

| 7 | Greater China Equity | -10.3% | -1.2% |

| 8 | Hong Kong Equity (Index Tracking) | -11.6% | -0.2% |

| 9 | Hong Kong Equity | -15.5% | -1.2% |

Analysis of Mixed Assets fund performance

In December, both mixed asset funds and equity funds experienced gains. This was due to the rise in the bond market, influenced by expectations of interest rate cuts by the Federal Reserve, resulting in a situation of “dual gains” for mixed asset funds. In 2023, the “DIS Core Accumulation Fund” and the “DIS 65 Plus Fund” had the highest increases, rising by 14.3% and 7.3% respectively. This was mainly because these funds had more investments in global stock markets, benefiting from the overall rise in global stock markets.

Table 3: Ranking of Mixed Assets Fund Performance According To 2023 Returns

| Ranking | Mixed Assets Sub-category Fund Index | 2023 Return(%) | December 2023 Return (%) |

| 1 | DIS Core Accumulation Fund | 14.3% | 4.0% |

| 2 | DIS Age 65 Plus Fund | 7.3% | 3.5% |

| 3 | Mixed Asset- (>80-100% Equity) | 6.3% | 3.0% |

| 4 | Mixed Asset- (>60-80% Equity) | 5.5% | 3.0% |

| 5 | Target-Date Fund | 5.5% | 2.9% |

| 6 | Mixed Asset- (>40-60% Equity) | 4.8% | 3.3% |

| 7 | Mixed Asset- (>20-40% Equity) | 4.7% | 3.4% |

| 8 | Dynamic Allocation Fund | 2.6% | 2.5% |

| 9 | Other Mixed Asset | 1.8% | 2.4% |

Analysis of Fixed Income Fund Performance

According to market expectations, the Federal Reserve maintained interest rates in December, but investors anticipate rate cuts to begin in March 2024. This has led to a rebound in bond funds. In December, the “Global Bond Fund” and “Asian Bond Fund” recorded gains of 4.0% and 2.3% respectively. Throughout 2023, the “Hong Kong Dollar Bond Fund” and “Global Bond Fund” performed the best, with increases of 5.7% and 4.7% respectively. Additionally, the “MPF Conservative Fund” continued to provide stable positive returns in 2023, with a growth rate of 3.5%.

Table 4: Ranking of Fixed Income Fund Performance According To 2023 Returns

| Ranking | Fixed Income Sub-category Fund Index | 2023 Return(%) | December 2023 Return (%) |

| 1 | Hong Kong Dollar Bond | 5.7% | 2.3% |

| 2 | Global Bond | 4.7% | 4.0% |

| 3 | HKD Money Market Fund | 3.9% | 0.6% |

| 4 | Asian Bond | 3.8% | 2.8% |

| 5 | MPF Conservative Fund | 3.5% | 0.4% |

| 6 | RMB Bond | 2.5% | 0.8% |

| 7 | Guaranteed Fund | 1.8% | 0.7% |

| 8 | RMB & HKD Money Market Fund | 0.8% | 0.4% |

Top 10 Best and Worst Performing Funds

Table 5: Top 10 Best Performing Funds in 2023

(Funds with less than one year of return data in 2023 are not included in the calculation)

| Fund Names | 2023 Return (%) | AUM (Million HKD) |

| Manulife Global Select (MPF) Scheme – Manulife MPF North American Equity Fund | 38.7% | 23,399.73 |

| China Life MPF Master Trust Scheme – China Life Retire-Easy Global Equity Fund | 35.0% | 233.78 |

| China Life MPF Master Trust Scheme – China Life US Equity Fund | 34.9% | 120.2 |

| MASS Mandatory Provident Fund Scheme – US Equity Fund | 28.2% | 821.48 |

| Manulife Global Select (MPF) Scheme – Manulife MPF International Equity Fund | 26.5% | 8,993.67 |

| BCT (MPF) Pro Choice – BCT (Pro) U.S. Equity Fund | 25.1% | 1,321.33 |

| Manulife Global Select (MPF) Scheme – Manulife MPF Japan Equity Fund | 24.8% | 4,312.99 |

| Hang Seng Mandatory Provident Fund – SuperTrust Plus – ValueChoice North America Equity Tracker Fund | 24.3% | 2,071.4 |

| HSBC Mandatory Provident Fund – SuperTrust Plus – ValueChoice North America Equity Tracker Fund | 24.3% | 7,905.27 |

| BOC-Prudential Easy-Choice Mandatory Provident Fund Scheme – BOC Prudential North America Index Tracking Fund | 24.3% | 5,497.53 |

Table 6: Top 10 Worst Performing Funds in 2023

(Funds with less than one year of return data in 2023 are not included in the calculation)

| Fund Names | 2023 Return (%) | AUM (Million HKD) |

| AMTD MPF Scheme – AMTD Invesco Hong Kong and China Fund | -20.6% | 106.96 |

| BCT Strategic MPF Scheme – Invesco Hong Kong and China Equity Fund – Unit Class A | -20.0% | 2,927.62 |

| Hang Seng Mandatory Provident Fund – SuperTrust Plus – Chinese Equity Fund | -18.2% | 2,778.29 |

| HSBC Mandatory Provident Fund – SuperTrust Plus – Chinese Equity Fund | -18.2% | 6,365.51 |

| MASS Mandatory Provident Fund Scheme – Hong Kong Equities Fund | -18.0% | 351.03 |

| Manulife RetireChoice (MPF) Scheme – Allianz Hong Kong Fund – Class A | -17.9% | 1,072.21 |

| Sun Life Rainbow MPF Scheme – Sun Life MPF Hong Kong Equity Fund – Class A | -16.7% | 32,162.32 |

| Haitong MPF Retirement Fund – Haitong Hong Kong SAR Fund – Class A | -16.3% | 169.32 |

| BOC-Prudential Easy-Choice Mandatory Provident Fund Scheme – BOC-Prudential China Equity Fund | -16.3% | 5,749.11 |

| Fidelity Retirement Master Trust – Hong Kong Equity Fund | -16.2% | 5,545.09 |

Analysis of 2023 Fund Switching

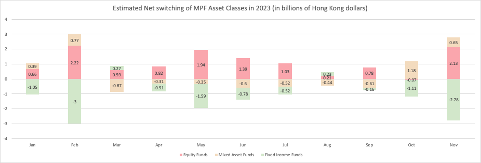

As of November 2023, MPF members transferred approximately HK$11.8 billion into equity funds. Out of this, around HK$11 billion was transferred from fixed income funds, and approximately HK$800 million was transferred from mixed asset funds. These figures reflect a more aggressive stance by members in 2023, with a focus on transferring funds into equity funds, particularly in the United States, Europe, and Japan. Additionally, due to the strong performance of the “DIS Core Accumulation Fund” in 2023, it also attracted a significant amount of fund transfers into the fund.

Chart 2: Monthly Fund switching Analysis for 2023 (by Asset Class)

The eMPF platform will be gradually rolled out in the second quarter

The eMPF platform has completed development and final testing in 2023. It is expected that in the second quarter of 2024, these trustees will gradually transfer the accounts of their MPF schemes to the platform. The initial batch of MPF trustees to join the platform includes YF Life Trustees Limited, China Life Trustees Limited, Bank of Communications Trustee Limited, Standard Chartered Trustee (Hong Kong) Limited, and Bank of East Asia (Trustees) Limited. The remaining MPF scheme accounts will be added to the platform in subsequent stages according to the trustees’ asset size from small to large, with the expectation that all MPF scheme accounts will be transferred to the platform and fully operational by 2025. GUM advises employers to pay attention to the platform’s implementation schedule to understand the timeline for the transfer of their MPF scheme accounts by the trustees. Employers should also encourage employees to make use of the platform, which provides a one-stop solution for all MPF administrative procedures, making it more convenient to manage their MPF investments.

Remarks:

The average MPF return per member is calculated using total MPF assets of the previous month. The latest average assets per member was HK$236,898 as of 30 November 2023. The number of MPF Scheme members was 4,694,000 as of 31 March 2023. The GUM MPF Composite Index return for December 2023 as of December 31, 2023.”

*The growth of all fund categories indexes is calculated by asset-weighted point-to-point growth. The data for December 2023 return is summarized from 1 December to 31 December 2023.

- The End -

中文版本:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com