【Hong Kong, December 18, 2023】According to the MPF Market Share Report released by GUM today, the total assets of the MPF market increased by 4.5% in November to HKD 1.11 trillion. In terms of market share, Manulife takes the lead with a share of 27.6%, followed by HSBC (17.6%) and Sun Life (11.1%).

After BCT reached a long-term agreement with Invesco, its market share in the MPF scheme increased to 7.3%, replacing BOC-Prudential as the fifth-largest MPF provider. In terms of changes in market share from the beginning of the year to the present, Manulife’s market share has grown by 0.61%, with investment returns increasing by 0.40%. On the other hand, Sun Life has experienced the largest loss in market share, with a decrease of 0.25%. This decline is primarily attributed to a drag in investment returns (-0.46%). [Refer to Table 1 for details]

Table 1:Market Share of Top 10 MPF Providers from the Beginning of 2023

| 2023 YTD Change in Market Shares | |||||

| Market Share Rank | Providers | Market Shares | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 27.6% | 0.21% | 0.40% | 0.61% |

| 2 | HSBC | 17.6% | -0.18% | -0.04% | -0.22% |

| 3 | Sun Life | 11.1% | 0.21% | -0.46% | -0.25% |

| 4 | AIA | 9.0% | -0.04% | 0.22% | 0.18% |

| 5 | BCT | 7.3% | 1.76% | -0.04% | 1.72% |

| 6 | BOC-Prud | 7.2% | 0.04% | 0.01% | 0.05% |

| 7 | Hang Seng | 5.7% | -0.02% | -0.08% | -0.10% |

| 8 | Principal | 5.5% | -0.17% | 0.06% | -0.11% |

| 9 | Fidelity | 4.3% | 0.01% | -0.02% | -0.01% |

| 10 | BEA | 2.6% | -0.03% | 0.01% | -0.02% |

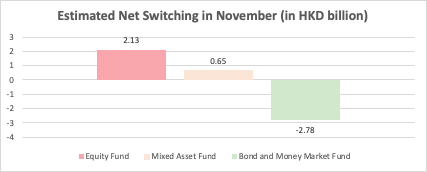

In November, there was a rebound in global stock markets. HKD 2.78 billion was transferred out of “Fixed Income Funds,” while HKD 2.13 billion was transferred into “Equity Funds,” and HKD 650 million was transferred into “Mixed Asset Funds.” Following the termination of three guaranteed funds by Principal last month, the “BEA (MPF) Master Trust Scheme” and “BCT Strategic MPF Scheme” also removed “Guaranteed Fund” from their plan in November. If members do not transfer their funds before the end of the month, the relevant funds will be transferred to the “DIS – Age 65 Plus Fund” within the same scheme, resulting in changes in fund allocation this month. Currently, there are still nine guaranteed funds available in the market. [Refer to Table 2 and 3 for details]

Table 2:Net Fund Switching in Major Asset Categories

Table 3: Plans in the market that include “Guaranteed Fund”

| Scheme | Constituent Fund | Trustee | Fund Size (HKD’m) |

| Manulife Global Select (MPF) Scheme | Manulife MPF Interest Fund | Manulife | 30,250 |

| Manulife Global Select (MPF) Scheme | Manulife MPF Stable Fund | Manulife | 14,270 |

| HSBC Mandatory Provident Fund – SuperTrust Plus | Guaranteed Fund | HSBC | 9,849 |

| AIA MPF – Prime Value Choice | Guaranteed Portfolio | AIAT | 9,275 |

| Hang Seng Mandatory Provident Fund – SuperTrust Plus | Guaranteed Fund | HSBC | 2,981 |

| China Life MPF Master Trust Scheme | China Life Joyful Retirement Guaranteed Fund | China Life | 1,404 |

| BCOM Joyful Retirement MPF Scheme | BCOM Guaranteed (CF) Fund | BCOM | 841 |

| SHKP MPF Employer Sponsored Scheme | Manulife Career Average Guaranteed Fund – SHKP | SCT | 458 |

| MASS Mandatory Provident Fund Scheme | Guaranteed Fund | YF Life | 198 |

Due to the aforementioned reasons, the conversion amounts of “Guaranteed Funds” and “DIS – Age 65 Plus Fund” are more noticeable. In November, the top five fund types that experienced net outflows were primarily “Guaranteed Fund,” “Mixed Asset-(>80% to 100% Equities),” “Asia Equity Fund,” “MPF Conservative Fund,” and “Mixed Asset Fund – (>60% to 80% Equities).” On the other hand, the top five asset types that received the most switching were “DIS – Age 65 Plus Fund,” “US Equity Fund,” “Hong Kong Equity Fund (Index Tracking),” “Other Equity Fund,” and “DIS – Core Accumulation Fund. [Refer to Table 3 and Table 4 for details]

Table 4: Top Five Fund Asset Types with Net Fund Outflows (in million HKD)

| Rank | Asset Class | Nov 2023 |

| 1 | Guaranteed Fund | -2,518 |

| 2 | Mixed Asset- (>80-100% Equity) Fund | -695 |

| 3 | Asian Equity Fund | -376 |

| 4 | MPF Conservative Fund | -371 |

| 5 | Mixed Asset- (>60-80% Equity) Fund | -284 |

Table 5: Top Five Fund Asset Types with Net Fund Inflows (in million HKD)

| Rank | Asset Class | Nov 2023 |

| 1 | DIS – Age 65 Plus Fund | 1,521 |

| 2 | United States Equity Fund | 1,228 |

| 3 | Hong Kong Equity Fund (Index Tracking) | 584 |

| 4 | Global Equity Fund | 549 |

| 5 | DIS – Core Accumulation Fund | 529 |

GUM Investment and Analytic Consultant, Martin Wan, pointed out, “In November, MPF assets were transferred to US stocks and the default investment strategy due to the strong rebound in global stocks, particularly in Europe and the US. The Chinese and Hong Kong markets underperformed, with the Hang Seng Index remaining stagnant around 16,700 points. Moody’s downgrade of Hong Kong’s outlook and the unresolved property crisis affected investor confidence. Despite this, the Hong Kong market is undervalued, but it will take time to regain investment confidence.” He reminded MPF members to allocate their assets based on their risk tolerance and investment objectives, and to avoid excessive fund portfolio conversions.

- The End -

中文版本:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com