【Hong Kong, January 23, 2024】According to the market share report on MPF released by GUM today, the total assets of the MPF market increased by 2.6% to HKD 1.14 trillion in December. In terms of market share, Manulife maintained its leading position with a share of 27.7% in 2023, while HSBC ranked second with a share of 17.6%, and Sun Life retained its third position with a share of 11.0%. Although their rankings remained unchanged, HSBC and Sun Life experienced a slight decline in market share by 0.22% and 0.29% respectively.

Despite BCT briefly surpassing BOC-Prud as the fifth-largest MPF provider in November, following their long-term agreement with Invesco, BOC-Prud reclaimed its position in December. It is anticipated that the competition for the fifth position in terms of market share ranking will remain intense throughout the year. [Refer to Table 1 for details]

Table 1:Market Share of Top 10 MPF Providers in 2023

| 2023 Change in Market Shares | |||||

| Market Share Rank | Providers | Market Shares | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 27.7% | 0.20% | 0.47% | 0.67% |

| 2 | HSBC | 17.6% | -0.16% | -0.06% | -0.22% |

| 3 | Sun Life | 11.0% | 0.26% | -0.55% | -0.29% |

| 4 | AIA | 9.0% | -0.05% | 0.24% | 0.19% |

| 5 | BOC-Prud | 7.3% | 0.06% | 0.01% | 0.07% |

| 6 | BCT | 7.2% | 1.74% | -0.04% | 1.70% |

| 7 | Hang Seng | 5.7% | -0.01% | -0.10% | -0.11% |

| 8 | Principal | 5.5% | -0.20% | 0.05% | -0.15% |

| 9 | Fidelity | 4.3% | 0.00% | 0.01% | 0.01% |

| 10 | BEA | 2.6% | -0.03% | 0.02% | -0.01% |

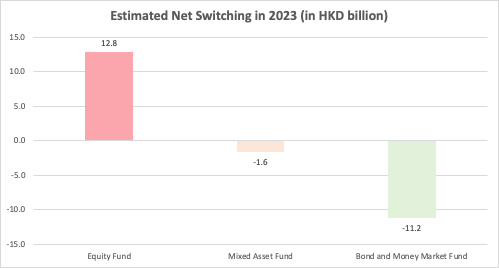

In 2023, a total of HKD 12.8 billion was transferred into “Equity Funds,” while “Fixed Income Funds” and “Mixed Asset Funds” experienced outflows of HKD 11.2 billion and HKD 1.6 billion respectively. The reason for this is believed to be the overall positive performance of the global stock market in 2023, which attracted many investors to switch to equity funds. Additionally, several “guaranteed funds” ceased operations in 2023, leading to significant outflows from fixed income funds. [Refer to Table 2 for more details.]

Table 2:Net Fund Switching in Major Asset Categories

In 2023, the top five fund types with the highest net outflows were “Guaranteed fund,” ” Mixed Asset- (>80-100% Equity) Fund,” ” Mixed Asset- (>60-80% Equity) Fund,” ” Greater China Equity Fund,” and ” Mixed Asset- (>40-60% Equity) Fund.” On the other hand, the top five asset types with the highest net inflows were ” United States Equity Fund,” ” DIS – Core Accumulation Fund,” ” DIS – Age 65 Plus Fund,” ” Conservative Fund,” and ” European Equity.” [Refer to Table 3 and Table 4 for details]

GUM’s Strategy and Investment Analyst, Martin Wan, pointed out, “After experiencing the “double kill” of equities and bonds in 2022, the results of fund transfers in 2023 indicate that members have become more aggressive in their risk preferences. High-risk equity funds recorded an inflow of HKD 12.8 billion, of which approximately HKD 11.2 billion came from lower-risk fixed income funds. In terms of individual funds, US equity funds were highly sought after by members and received an inflow of nearly HKD 9.66 billion. With an average return of 28% in 2023, this data suggests that some actively managed MPF members were able to significantly outperform the market.

However, it is important to note that MPF is a long-term retirement investment. MPF members should view it from a long-term investment perspective and should not try to predict the best market entry timing to capture short-term market movements.

Table 3: Top Five Fund Asset Types with Net Fund Outflows (in million HKD)

| Rank | Asset Class | 2023 Outflow |

| 1 | Guaranteed Fund | -14,367 |

| 2 | Mixed Asset- (>80-100% Equity) Fund | -6,104 |

| 3 | Mixed Asset- (>60-80% Equity) Fund | -3,804 |

| 4 | Greater China Equity Fund | -2,124 |

| 5 | Mixed Asset- (>40-60% Equity) Fund | -1,994 |

Table 4: Top Five Fund Asset Types with Net Fund Inflows (in million HKD)

| Rank | Asset Class | 2023 Inflow |

| 1 | United States Equity Fund | 9,655 |

| 2 | DIS – Core Accumulation Fund | 6,868 |

| 3 | DIS – Age 65 Plus Fund | 5,072 |

| 4 | Conservative Fund | 3,155 |

| 5 | European Equity | 2,860 |

中文版本:

-The End-

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.