【Hong Kong, April 23, 2024】GUM released the MPF Market Analysis Report March 2024 today. As of March, the total assets of the MPF market rose by 1.9% to HKD 1.18 trillion. In terms of market share, Manulife remained in the lead with a share of 28.0%, followed by HSBC (17.6%) and Sun Life (10.8%) in second and third place, respectively.

In 2024 YTD, Manulife’s market share saw a noticeable change increasing by 0.27%, primarily driven by investment returns. HSBC increased 0.02%, while Sun Life’s market share decreased by 0.17%. Fourth-ranked AIA saw a slight increase of 0.03% in market share, reaching 9.1%. BOC-Prud secure the fifth spot with 7.3% market share. [Refer to Table 1 for details]

Table 1: 2024 YTD Market Share of MPF Providers (Top 10)

| 2024 YTD Change in Market Shares | |||||

| Market Share Rank | Provider | Market Shares | Due to Net Switching | Due to Investment Return | Total change |

| 1 | Manulife | 28.0% | 0.07% | 0.20% | 0.27% |

| 2 | HSBC | 17.6% | 0.00% | 0.02% | 0.02% |

| 3 | Sun Life | 10.8% | 0.02% | -0.19% | -0.17% |

| 4 | AIA | 9.1% | 0.00% | 0.03% | 0.03% |

| 5 | BOC-Prud | 7.3% | 0.03% | -0.02% | 0.01% |

| 6 | BCT | 7.2% | -0.03% | -0.05% | -0.08% |

| 7 | Hang Seng | 5.7% | 0.00% | -0.01% | -0.01% |

| 8 | Principal | 5.4% | -0.08% | 0.01% | -0.07% |

| 9 | Fidelity | 4.3% | 0.00% | 0.01% | 0.01% |

| 10 | BEA | 2.6% | 0.00% | 0.01% | 0.01% |

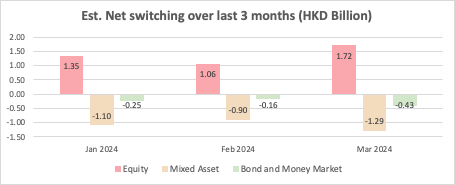

In the first quarter of 2024, the “Mixed Asset Fund” and “Fixed Income Fund” had capital outflows of HKD 3.29 billion and HKD 0.84 billion, respectively, which flowed into the “Equity Fund,” reflecting members’ preference for higher-risk funds. [Refer to Table 2 for more details]

Table 2:Net Fund Switching in Major Asset Categories in 2024Q1

In Q1, the top five asset types with the highest net switching out were ”Hong Kong Equity Fund”, “Mixed Asset Fund (>80% -100% Equity)”, “Greater China Equity Fund”, “Mixed Asset Fund (>60% -80% Equity)” and “Hong Kong Equity Fund (Index Tracking)”.

On the other hand, The top five asset types with the highest net inflows include the “United States Equity Fund”, “DIS – Core Accumulation Fund”, “Global Equity Fund”, “Japan Equity Fund”, and “Global Bond Fund”, which together account for over 90% of the total fund transfers. Particularly noteworthy is the “Japan Equity Fund,” which accounts for 10% of the total fund inflows, considering that this fund represents only around 1% of the MPF market.” [Refer to Table 3 and Table 4 for details]

GUM’s Strategy and Investment Analyst , Martin Wan, pointed out, “In Q1, there was a strong demand for Japanese stocks as a total of 1.5 billion was invested in Japanese equity funds. Although Japanese equity funds make up less than 1% of MPF’s total assets and there are only three providers offering them, members can consider the proportion of Japanese stocks in certain Asian funds to align with their risk and investment preferences. Additionally, expectations of interest rate cuts boosted inflows into global bond funds, but unexpected US inflation data dampened bond fund performance. It’s important for members to view MPF as a long-term retirement investment and avoid trying to time the market based on short-term fluctuations.”

Table 3: Top Five Fund Asset Types with Net Fund Switching out in 2024Q1 (in HKD million)

| Rank | Asset Class | 2024Q1 |

| 1 | Hong Kong Equity Fund | (HK$2,896) |

| 2 | Mixed Asset Fund (>80-100% Equity) | (HK$2,489) |

| 3 | Greater China Equity Fund | (HK$2,193) |

| 4 | Mixed Asset Fund (>60-80% Equity) | (HK$1,827) |

| 5 | Hong Kong Equity Fund (Index Tracking) | (HK$1,382) |

Table 4: Top Five Fund Asset Types with Net Fund Switching in 2024Q1 (in HKD million)

| Rank | Asset Class | 2024Q1 |

| 1 | United States Equity Fund | HK$7,955 |

| 2 | DIS Core Accumulation Fund | HK$2,271 |

| 3 | Global Equity Fund | HK$1,759 |

| 4 | Japanese Equity Fund | HK$1,539 |

| 5 | Global Bond Fund | HK$805 |

- The End -

中文版本:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

GUM

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: : cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.