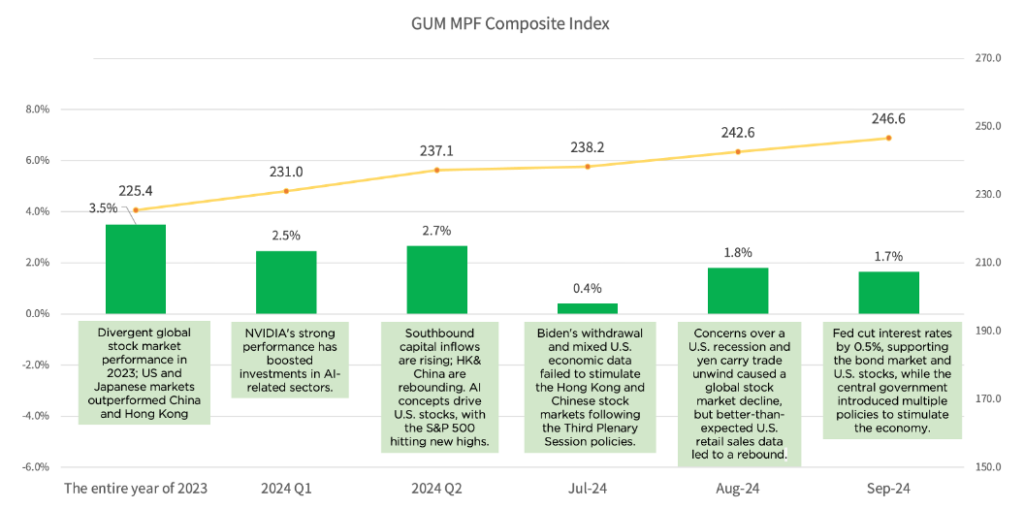

【Hong Kong,September 30, 2024】– GUM today announced the MPF performance for Q3 2024. Year-to-date, as of September 24, the “GUM MPF Composite Index” increased by 9.4%, reaching 246.6 points; the “GUM MPF Equity Fund Index” rose by 12.9%, reaching 331.5 points; the “GUM MPF Mixed Asset Fund Index” increased by 9.1%, reaching 251.0 points; and the “GUM MPF Fixed Income Fund Index” rose by 2.8%, reaching 129.1 points. The average earnings per person have reached HKD 23,006 YTD, while the total average for 2023 was HKD 8,171. This year’s returns have temporarily nearly tripled last year’s figures.

Additional Information: “The press release on MPF performance data as of September 24 indicates that due to the recent significant rise in the Hong Kong and China stock markets, the estimated proportion of MPF assets in the Hong Kong and China stock markets is about 30%. If we project based on the Hang Seng Index closing price of 21,321 at noon on September 30, the year-to-date return of the MPF will increase to approximately 12%, driving the year-to-date average return to HKD 33,000.”

Overall Review and Outlook

The overall performance of the MPF has been outstanding YTD, with the GUM MPF Index recording positive returns across all categories. In the third quarter, global stock markets demonstrated resilience, steadily recovering despite concerns about a potential U.S. economic recession and declines caused by the yen carry trade unwind. The Hong Kong and Chinese stock markets saw a significant rebound in September, benefiting from a coordinated economic stimulus package introduced by institutions such as the People’s Bank of China, which included measures like a 0.5% reserve requirement ratio cut and lower mortgage rates. The Hang Seng Index surpassed 20,000 points, reaching its highest level of the year.

Looking ahead to the fourth quarter of 2024, GUM’s Managing Director, Michael Chan noted: “This year, the MPF has seen both equity and bond markets rise, with a YTD return of 9%. With the central government implementing stimulus policies, trading volume in the Hong Kong and Chinese stock markets has surged, and market expectations remain optimistic. However, with the U.S. elections approaching and rising geopolitical risks, investors should avoid concentrating on a single market. Low-risk members may consider allocating to conservative funds for stable returns and should pay attention to the support that U.S. interest rate cuts provide for bond funds.”

Table 1: Overall Performance of MPF and Average Return

| Index | Value | 2024 YTD Return (%) | September Return (%) |

| GUM MPF Composite Index | 246.6 | +9.4% | +1.7% |

| GUM MPF Equity Fund Index | 331.5 | +12.9% | +2.3% |

| GUM MPF Mixed Asset Fund Index | 251.0 | +9.1% | +1.5% |

| GUM MPF Fixed Income Fund Index | 129.1 | +2.8% | +0.5% |

| Average MPF Gain/Loss Per MemberNote 1 (HK$) | +23,006 | +4,408 | |

Figure 1: Analysis of Return in 2024

Equity Fund Performance

Table 2: Ranking of Equity Fund Performance According to 2024 YTD Return

| Ranking | Equity Sub-category Fund Index | 2024 YTD Return (%) | September 2024 (%) |

| 1 | United States Equity Fund | 18.8% | 1.1% |

| 2 | Japanese Equity Fund | 17.8% | -0.9% |

| 3 | Global Equity Fund | 14.5% | 0.9% |

| 4 | Asian Equity Fund | 14.5% | 2.3% |

| 5 | Hong Kong Equity Fund (Index Tracking) | 13.5% | 6.4% |

| 6 | Other Equity Fund | 11.2% | -3.8% |

| 7 | Greater China Equity Fund | 10.4% | 4.9% |

| 8 | Hong Kong Equity Fund | 9.1% | 5.8% |

| 9 | European Equity Fund | 7.6% | -1.1% |

Mixed Asset Fund Performance

Table 3: Ranking of Mixed Asset Fund Performance According to 2024 YTD Return

| Ranking | Mixed Asset Sub-category Fund Index | 2024 YTD Return (%) | September Return (%) |

| 1 | Target-Date Fund | 11.4% | 2.0% |

| 2 | Mixed Asset Fund – (>80-100% Equity) | 11.4% | 1.9% |

| 3 | DIS Core Accumulation Fund | 10.8% | 1.0% |

| 4 | Mixed Asset Fund – (>60-80% Equity) | 9.0% | 1.6% |

| 5 | Mixed Asset Fund – (>40-60% Equity) | 7.0% | 1.5% |

| 6 | Dynamic Allocation Fund | 6.9% | 1.4% |

| 7 | DIS Age 65 Plus Fund | 5.1% | 1.1% |

| 8 | Mixed Asset Fund – (>20-40% Equity) | 5.0% | 1.4% |

| 9 | Other Mixed Asset Fund | 3.9% | 0.9% |

Fixed Income Fund Performance

Table 4: Ranking of Fixed Income Fund Performance According to 2024 YTD Return

| Ranking | Fixed Income Sub-category Fund Index | 2024 YTD Return (%) | September Return (%) |

| 1 | Hong Kong Dollar Bond Fund | 4.6% | 0.9% |

| 2 | Asian Bond Fund | 4.4% | 1.1% |

| 3 | RMB Bond Fund | 4.3% | 1.1% |

| 4 | HKD Money Market Fund | 3.8% | 0.5% |

| 5 | Conservative Fund | 2.8% | 0.2% |

| 6 | RMB & HKD Money Market Fund | 2.6% | 0.6% |

| 7 | Guaranteed Fund | 2.4% | 0.6% |

| 8 | Global Bond Fund | 2.2% | 1.4% |

Analysis of Net Fund Switching

Table 5: Year-On-Year Comparison of Net Fund Switching Amount

| 2024 (January To August) | 2023 (January To August) | 2022 (January To August) | |

| Net Switching (in HKD million) | HK$32,622 | HK$16,574 | HK$16,961 |

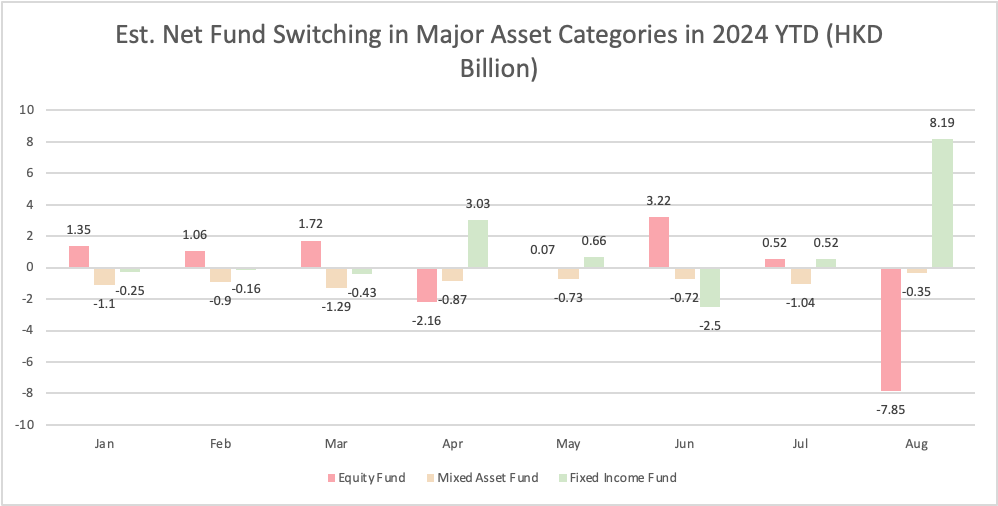

In 2024, the net switching for the MPF from January to August increased significantly by 97% to HKD 32.6 billion compared to 2023, indicating that more members are actively managing their MPF.

Table 6: Estimated Net Transfer of MPF Asset Classes from January to August 2024

In August 2024, there was an unusual change in net switching, with HKD 8.2 billion flowing into “Fixed Income Funds,” a significant increase compared to the average levels observed YTD. Of this, HKD 7.85 billion was switching out from “Equity Funds.” This trend may be related to the yen carry trade unwind at the beginning of August and concerns about an economic recession in U.S., leading members to prefer more conservative types of funds.

Table 7: 2024 YTD Top 5 Net Switching In/Out of Asset Classes

| Fund Category | 2024 YTD Net Switching In (in HKD million) | Fund Category | 2024 YTD Net Switching Out (in HKD million) |

| United States Equity Fund | HK$10,823 | Mixed Asset Fund – (>80-100% Equity) | (HK$6,022) |

| DIS Core Accumulation Fund | HK$5,651 | Hong Kong Equity Fund | (HK$5,972) |

| Global Bond Fund | HK$4,590 | Greater China Equity Fund | (HK$4,664) |

| Conservative Fund | HK$3,893 | Mixed Asset Fund – (>60-80% Equity) | (HK$4,589) |

| Global Equity Fund | HK$2,544 | Hong Kong Equity Fund (Index Tracking) | (HK$3,842) |

(Data as of August 31 2024)

As of August, the five fund categories with the highest net switching out YTD include “Greater China Equity Funds” and the mixed asset funds with a higher equity allocation, both of which are closely linked to the Hong Kong and Chinese stock markets. On the other hand, “U.S. Equity Funds” continued to lead as the category with the highest net switching in this year, with HKD 10.8 billion net switching in, and it also recorded the highest returns among all MPF fund categories. The second highest net switching in category was the “Default Investment Strategy – Core Accumulation Fund,” which ranked among the top in returns within the mixed asset category. Previously, market expectations that the Federal Reserve would initiate its first interest rate cut in September attracted significant capital to “Global Bond Funds” in July and August, propelling them to become the third highest net inflow category YTD.

Note:

- The average return is calculated based on the total MPF market assets of HK$265,532 per capita as of August 31, 2024, with a total of 4,754,000 MPF scheme members as of December 31, 2023. The GUM MPF Composite Index return is as of September 24, 2024.

- The growth rates of all fund indices are calculated based on asset-weighted, point-to-point returns. The September returns are from September 1, 2024 to September 24, 2024. The year-to-date returns are from January 1, 2024 to September 24, 2024.

- The End -

中文版本:

About GUM

GUM is a boutique consulting firm that provides solutions to corporate on MPF and employee benefits. We focus on people and that is why we put “U” in the very core of our brand “GUM”. Our priorities are always meeting the needs of our corporate clients and their employees, our strategic partners as well as all MPF members of Hong Kong. With our vast market experience and expert teams around actuarial, investment and employee communication, GUM leads the market to innovate, walking hand in hand with our clients to go faster and further.

Media Enquiries, please contact:

Miss Cherry Chan / Miss Karen Siu

Phone: (852) 9126-9200 / (852) 6011-5603

Email: cherrychan@gumhk.com / karensiu@gumhk.com

Website: www.gumhk.com

This document provided the information on an “AS IS” basis. The Company undertakes no obligation to update any of the information contained in this document. Some information contained in this document contains forward-looking statements. The words “believe”, “expect” and similar expressions are also intended to identify forward-looking statements. These forward-looking statements are not historical facts. Rather, these forward-looking statements are based on the current beliefs, assumptions, expectations, estimates, and projections of our management. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Consequently, actual results could differ materially from those expressed, implied or forecasted in these forward-looking statements. Reliance should not be placed on these forward-looking statements.